Intermediary-only specialist lender

Credits: Warren Lewis – Financial Reporter on our publication: Intermediary-Only Specialist Lender | FHL: launches New Fixed-Rate Green ABC Landlord Products. Until next time, stay Connect!

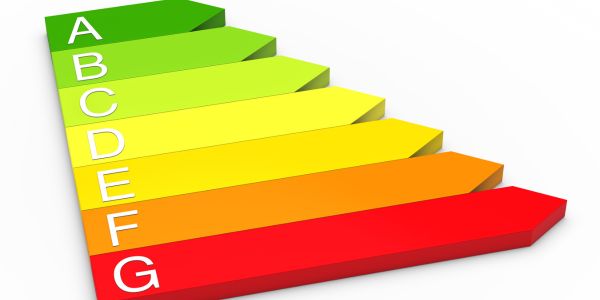

For buy-to-let landlords seeking to purchase or remortgage, a selection of five-year fixed-rate options is now accessible. Rates begin at 3.14%. These options apply up to 75% Loan-to-Value (LTV) and feature a reduced product fee of 0.5%. Borrowers can enjoy cashback rewards from £250 to £750 based on the property’s Energy Performance Certificate (EPC) rating. Early remortgaging is permitted. These products are open to individual and limited companies, portfolio, and non-portfolio landlords.

Owner-occupier borrowers looking to buy or remortgage can explore various two-year fixed-rate options with a £595 product fee. These options are available at both 75% and 85% LTV, with rates starting at 3.04%. Like buy-to-let products, cashback incentives between £250 and £750 are offered upon completion, depending on the property’s EPC rating. These owner-occupier products are applicable on a capital and interest-only basis.

Introducing Foundation Home Loans’ Green Mortgage Options

Foundation Home Loans emphasises that these products are tailored for individuals interested in acquiring more energy-efficient homes. They are designed to encourage borrowers to enhance their properties’ EPC ratings. The lender aims to cater to the growing demand for environmentally conscious mortgage options. They provide flexibility and rewards tied to energy performance.

George Gee, Commercial Director at Foundation Home Loans, said: “We want to encourage and reward those who choose to buy energy-efficient properties or improve those they own. Energy efficiency in UK housing will likely become more central to the Government’s green agenda. As one of the first specialist lenders to enter the ‘Green’ mortgage market, we remain committed to innovating ‘Green’ product options for both landlords and owner-occupiers. This new range offers cashback to help meet the costs of maintaining energy-efficient properties while retaining competitive rates and reduced product fees.

Government regulations currently affect properties in the private rental sector. However, our research shows a growing demand for ‘Green’ mortgage products among owner-occupiers. There is increasing demand from both groups for environmentally-friendly housing stock.”

Credits: Warren Lewis – Financial Reporter on our publication: Intermediary-Only Specialist Lender | FHL: launches New Fixed-Rate Green ABC Landlord Products. Until next time, stay Connect!

Commission disclosure: We are a credit broker and not a lender. We have access to an extensive range of lenders. Once we have assessed your needs, we will recommend a lender(s) that provides suitable products to meet your personal circumstances and requirements, though you are not obliged to take our advice or recommendation. Whichever lender we introduce you to, we will typically receive commission from them after completion of the transaction. The amount of commission we receive will normally be a fixed percentage of the amount you borrow from the lender. Commission paid to us may vary in amount depending on the lender and product. The lenders we work with pay commission at different rates. However, the amount of commission that we receive from a lender does not have an effect on the amount that you pay to that lender under your credit agreement.

Making a Complaint: It is our intention to provide you with a high level of customer service at all times. If there is an occasion when we do not meet these standards and you wish to register a complaint, please write to: Compliance Department; Connect IFA Ltd, 39 Station Lane, Hornchurch, RM12 6JL or call: 01708 676110. If you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service www.financial-ombudsman.org.uk