Short-Term Loans vs Bridging Finance – Know the Difference. At a recent mortgage industry event, a standout conversation unfolded around short-term loans and bridging finance, sparked by a lender’s new offering. Liz Syms, CEO of Connect for Intermediaries, delivered valuable insights that clarified how the two financial tools differ and when brokers should recommend each.

This discussion struck a common chord:

“Aren’t bridging loans and short-term loans basically the same thing?”

Spoiler: they’re not, and that distinction matters.

Let’s start with this question below:

What Is Bridging Finance?

Bridging finance is a specialist funding solution designed to bridge the gap between property transactions. For example, a client might want to purchase a new property before their current one sells. In such cases, bridging loans provide fast, short-term funding, often secured against the property itself.

Bridging loans typically involve:

-

Higher interest rates

-

A short repayment window (often 6–18 months)

-

Security against residential or commercial property

-

Use cases tied directly to property transactions

They’re ideal for clients navigating chain breaks, auction purchases, or time-sensitive acquisitions. For brokers handling these cases, our Specialist Mortgage Network for Advisers offers structured support and lender access.

What Are Short-Term Loans?

Short-term loans, in contrast, offer immediate funding for broader financial needs, including property. They can help with:

-

Urgent business expenses

-

Tax liabilities

-

Cashflow gaps

-

Debt consolidation

While they may also be secured, many short-term loan products offer greater flexibility in security type, loan purpose, and repayment plans. This makes them useful across a range of financial scenarios.

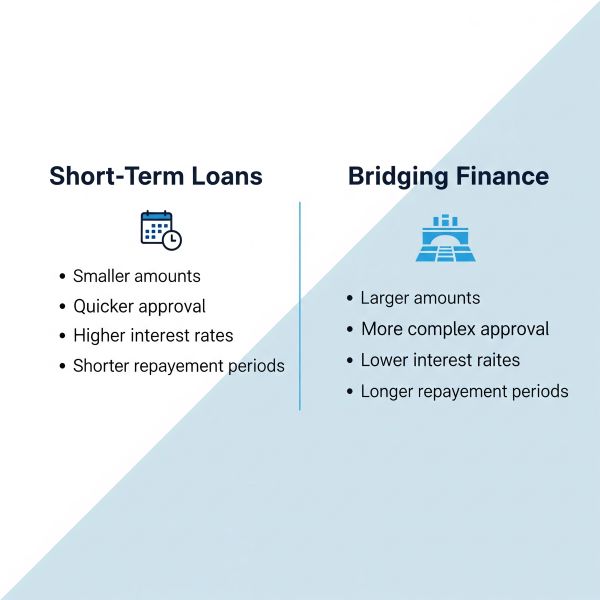

Bridging vs Short-Term: Why the Confusion?

Both products deliver fast access to capital, but their structure, terms, and ideal use cases differ. Bridging is highly specialised, often tied to real estate. Short-term loans offer broader applicability and may be a smarter alternative to remortgaging in some cases.

For a deeper look at refinancing vs alternative lending, explore our Remortgage Options.

Broker Tip: Match the Tool to the Goal

Advisers must understand the client’s timeline, risk appetite, and financial objectives. Is the funding need tied to a property deadline or a business obligation? Is the client better suited for a structured real estate product or a flexible, multi-purpose loan?

This kind of strategic matching isn’t just good service; it’s a competitive advantage.

Need help structuring deals like these? Our Mortgage Adviser Support Hub offers expert guidance and lender matchmaking.

When Speed Matters: Bridging Loans vs. Short-Term Finance

In high-pressure property scenarios such as auction purchases with 21-day deadlines, speed isn’t just an advantage, it’s a requirement. In these moments, bridging finance has traditionally been the go-to solution, offering fast access to funds for time-sensitive acquisitions.

However, today’s evolving lending landscape raises a timely question: Can bridging lenders still deliver at the pace modern borrowers demand?

Some established players continue to lead the pack in rapid completions, but a new wave of lenders has entered the market, offering short-term loans. While the terms are often used interchangeably, the differences are more than semantic and matter.

Bridging Finance or Short-Term Loan?

During a recent industry panel, Liz Syms, CEO of Connect for Intermediaries, unpacked the distinction between bridging loans and the emerging class of short-term finance providers.

“The terminology may be evolving,” Syms noted, “but the product purposes are not always aligned.”

She noted that bridging loans are typically used to cover a temporary funding gap, such as when purchasing a property before securing a traditional mortgage. These are often secured against property, with clear exit strategies like remortgaging or resale.

By contrast, short-term loans might serve a different purpose: quick cash-flow injections, smaller unsecured loans, or bridging gaps in non-property-related finance. For example, they could be used by business owners needing fast capital or investors needing flexibility without committing to a property transaction.

Underwriting Tightens as Bridge Loan Pricing Drops

The UK’s bridge loan market has undergone a dramatic shift in pricing in recent years. Once averaging 1.5% per month, bridge loans are now offered at competitive rates as low as 0.59% per month. While these lower rates benefit borrowers, they also come with a significant trade-off: tighter underwriting criteria and greater lender scrutiny.

As lenders jostle for the most attractive pricing, their risk appetite has narrowed. The result? A more intricate and data-driven underwriting process. Lenders are now demanding enhanced due diligence, granular asset information, and robust exit strategies from applicants. For advisers, this means preparing clients for slower turnarounds and deeper documentation requirements.

These shifts represent more than administrative friction; they signal a new normal. Borrowers and brokers must evolve in tandem with this more cautious lending climate. Preparing for stricter underwriting standards is no longer optional; it’s essential for successfully navigating today’s specialist mortgage space.

Short-Term Loans vs Bridging Finance: What’s the Real Difference?

At a recent industry roundtable, a hot topic took centre stage: Are short-term loans and bridging finance truly different? For many advisers, these terms have become interchangeable. But in reality, short-term finance is evolving, and its new direction could be a better fit for cost-conscious clients.

Today’s short-term lenders aren’t just racing to beat completion times; they’re creating flexible, bespoke solutions tailored to diverse funding needs. A strong example? A client looking to purchase and redevelop a semi-commercial property using permitted development rights.

Instead of following the typical bridging finance route, the client uses their unencumbered asset as security for a more affordable short-term loan. This solution avoids higher fees, offers tailored repayment terms, and fits seamlessly into the project’s financial roadmap.

Key takeaways:

-

Bridging is often costlier and geared toward urgency.

-

Short-term loans can offer better rates, greater flexibility, and better strategic alignment.

-

Once the project completes, clients can transition to buy-to-let mortgages, freeing capital and completing the investment cycle efficiently.

For clients seeking creative finance without sacrificing long-term stability, short-term solutions offer a powerful alternative. To explore lender options and adviser resources, visit our Mortgage Adviser Support Hub.

Know Your Client: The Real Driver of Lending Strategy

Choosing between speed and cost isn’t just a technical decision; it’s a strategic one. For advisers, the most critical question to ask is: What does your client truly need?

If your client values cost-efficiency and has the luxury of time, a tailored short-term loan may deliver optimal value. If speed is critical, such as bridging a property chain or securing auction finance, then bridging finance could be more suitable, even at a higher cost.

Advisers must be prepared to ask difficult but necessary questions:

-

Does your client need funding fast, or is cost their main concern?

-

Can their existing property be leveraged creatively to unlock better terms?

-

Are they building toward a refinance or long-term let?

The most successful brokers are those who move beyond templates and lean into strategic conversations. With so many product types available in the UK mortgage market, alignment between lender and borrower isn’t just helpful, it’s essential.

Thank you for reading our publication “Short-Term Loans and Bridging Finance | Distinct Difference.” Stay “Connect“-ed for more updates soon!