New Build

In a bid to aid homebuyers, TSB has raised its Loan-to-Value (LTV) limit for newly built homes. This change marks a significant step forward for those aspiring to own modern properties. Furthermore, it reflects TSB’s proactive approach to meeting evolving market demands.

The increase in the LTV cap offers financial flexibility to prospective buyers, making new homes more accessible. Consequently, this move could stimulate growth within the UK housing market. Additionally, it positions TSB as a forward-thinking lender in a competitive industry.

Moreover, by enhancing affordability, TSB is empowering customers to take advantage of emerging opportunities in property ownership. This adjustment reaffirms the bank’s commitment to supporting its customers while adapting to an ever-changing financial landscape.

Such initiatives benefit individual buyers and contribute to a healthier housing market overall. This demonstrates TSB’s broader dedication to fostering economic stability and innovation within the UK mortgage sector.

By aligning its services with market trends, TSB is paving the way for a more accessible future for homebuyers. Whether you are a first-time buyer or a seasoned investor, this change opens doors to exciting new possibilities.

What are we expecting this to happen?

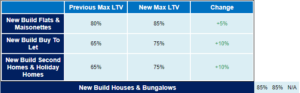

These changes particularly benefit buyers of new-build flats, maisonettes, houses, and bungalows. Moreover, the maximum LTV for second homes, holiday homes, and Buy to Let properties has increased from 65% to 75%. This reflects TSB’s commitment to supporting diverse property ownership goals across the UK.

Importantly, the LTV offered to individuals depends on their unique credit score. This ensures a personalised lending approach based on the applicant’s financial circumstances. Additionally, these updates demonstrate TSB’s adaptability to meet customers’ evolving needs. They align with the growing demand for flexible financing options in the UK mortgage market.

Effective from 16 November, these changes underscore TSB’s commitment to empowering buyers. The improvements help more individuals secure funding for newly built properties in a competitive real estate landscape.

With these updates, TSB reaffirms its dedication to supporting property buyers. This makes achieving property ownership more accessible while maintaining a focus on flexibility and inclusion.

Here’s a summary of the changes:

TSB is helping First-Time Buyers and Home movers by offering lower rates on new-build properties for Help to Buy, Shared Equity, and Shared Ownership mortgages.

Connect Mortgage Network | Here to provide advisers with product updates

The Role of Connect in Supporting Mortgage Networks

In UK mortgage networks, Connect holds a crucial position in advancing expertise, particularly in the new-build property sector. Importantly, our commitment extends far beyond conventional mortgage offerings, ensuring brokers have access to tailored lending solutions.

These specialised financial products empower advisers to better support clients by exploring opportunities in new-build homes. Furthermore, they highlight the importance of maintaining up-to-date knowledge of product features and eligibility requirements. Through our innovative lender digital learning programme, advisers can deepen their understanding while earning valuable Continuous Professional Development (CPD) credits.

By fostering education and product awareness, we actively contribute to the growth of informed mortgage practices. This initiative strengthens adviser-client relationships and enhances the scope of opportunities within the UK mortgage market.

Together, these efforts provide top-notch advice and service to our expert mortgage brokers’ client base.

Thank you for reading our publication “Insights for New CeMAP Qualified | Join A Mortgage Academy.” Stay “Connect“-ed for more updates soon!