TSB Expands Mortgage Access for New Build Properties with Higher LTV Limits. TSB has made a decisive move to support UK homebuyers by increasing its Loan-to-Value (LTV) threshold for new-build properties. This change improves affordability and opens new doors for buyers nationwide.

This LTV uplift reflects TSB’s forward-thinking response to shifting market needs and provides greater flexibility for those seeking to purchase a new build home. Whether you’re stepping onto the ladder or upgrading, this adjustment may significantly reduce your upfront costs and bring your dream property within reach.

Why TSB’s LTV Increase Matters for New Build Buyers

Higher LTV caps allow buyers to secure a mortgage with a smaller deposit, which is crucial for first-time buyers navigating high property prices. TSB’s initiative aligns with the broader trend of lenders adapting to the growing demand for modern, energy-efficient homes.

For more tailored support, explore how our first-time buyer mortgage options can work alongside builder incentives and government schemes.

Supporting an Evolving Market

This move isn’t just about individual affordability; it signals broader support for the UK’s new-build housing market. By helping more people access lending on newly constructed homes, TSB contributes to market stability, growth, and innovation.

If you’re planning to buy off-plan or at close to completion, working with a new-build mortgage broker ensures your application meets lender timelines and criteria specific to these properties.

What are we expecting this to happen?

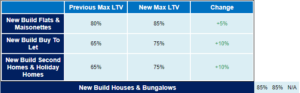

TSB has introduced key updates that enhance financial flexibility for new-build property buyers and align its loan-to-value (LTV) limits across property types. Whether you’re buying a flat, maisonette, house, or bungalow, the maximum LTV for new-build properties is 85%, ensuring equal access to funding.

This is a game-changer for those eyeing new build flats and maisonettes, which previously had lower LTV ceilings.

Enhanced Support for Second Homes and Buy to Let

In addition to standard residential purchases, TSB has increased the maximum LTV for:

-

Second homes

-

Holiday homes

These property types now offer up to 75% LTV, up from 65%, a bold move that supports both investors and lifestyle buyers. If you’re considering entering the rental market or diversifying your portfolio, explore how Buy-to-Let mortgages can help you navigate these changes.

Personalised Lending, Backed by Smarter Credit Decisions

LTVs remain tailored to individual applicants based on credit scoring, ensuring responsible lending while empowering more people to step into new-build homeownership. This aligns with rising demand for personalised mortgage solutions that balance affordability and access.

What This Means for New Build Buyers

Effective from 16 November, these policy changes reaffirm TSB’s commitment to inclusivity and innovation in the mortgage market. Whether you’re a first-time buyer, home mover, or investor, accessing a newly constructed property just became more achievable.

If you’re unsure how these updates apply to your situation, speaking with a mortgage broker experienced in new builds can help you secure the most competitive deal with minimal stress.

More Than Mortgages: A Path to Ownership

TSB’s approach mirrors a broader shift in the UK housing market: flexibility, digital processing, and proactive affordability models are becoming the norm. By levelling the LTV limits and enhancing access for niche ownership categories, TSB continues to champion modern home financing.

Here’s a summary of the changes:

TSB is helping First-Time Buyers and Home movers by offering lower rates on new-build properties for Help to Buy, Shared Equity, and Shared Ownership mortgages.

Supporting Mortgage Networks With New Build Mortgage Expertise

At Connect, we play a pivotal role within the UK’s leading mortgage networks, particularly in navigating the fast-evolving new-build property sector. Our support goes beyond traditional offerings; we equip advisers with specialist new build mortgage solutions designed to meet the demands of today’s complex housing market.

Our adviser partners benefit from direct access to tailored mortgage products for new build homes, helping them secure the right financing for clients purchasing off-plan or through developer-led schemes. We understand that success in this space requires agility and knowledge, which is why we prioritise continuous product education.

Stay Ahead With CPD-Accredited Digital Learning

Connect’s lender digital learning programme empowers advisers to stay sharp in a competitive landscape. Through on-demand training modules, brokers gain deeper insight into product criteria, affordability models, and new-build eligibility requirements, while earning CPD credits that support ongoing regulatory compliance.

We believe informed advisers offer better service, and by elevating knowledge standards across our mortgage broker network, we strengthen trust and long-term client relationships.

Driving Smarter Outcomes for New Build Clients

From fast-tracking mortgage offers on developer sites to unlocking buyer incentives, we help advisers turn opportunity into results.

Thank you for reading our publication “New Build Properties | Mortgages, Incentives & Advice.” Stay “Connect“-ed for more updates soon!