Why Independent Financial Advisers Are Choosing the Connect Network | Choosing an IFA network is one of the most important decisions you will make in your career as a financial adviser. Whether you are a newly qualified adviser or an experienced firm looking for growth, you need a network that offers regulatory support, advanced technology, and whole-of-market access, all while preserving your independence.

At Connect Network, our mission is to empower IFAs across the UK with the tools, expertise, and community to thrive on their own terms.

A Safety Blanket

Financial adviser networks serve as a crucial safety blanket for their members by acting as an intermediary between financial advisers and regulatory bodies. By becoming an Appointed Representative (AR) within a network, advisers can ensure that they adhere to the stringent standards set forth by financial regulators. This relationship is beneficial because the network assumes a significant portion of the regulatory responsibilities that might otherwise overwhelm an individual adviser or a small firm.

These networks provide comprehensive support. They offer regulatory expertise and practical assistance in managing compliance tasks. This can include everything from keeping up-to-date with changing regulations to filing the necessary paperwork, thereby reducing the administrative burden on the advisers themselves.

Financial adviser networks typically have a wealth of experience dealing with regulatory bodies and can offer strategic advice on navigating complex regulatory landscapes. This expertise is valuable for developing effective compliance strategies and avoiding pitfalls that could lead to sanctions or other negative consequences.

Time and Money

The costs of operating independently can be high. This includes regulatory fees, compliance costs, and PI insurance. IFA networks leverage economies of scale. They offer comprehensive packages that save time and money.

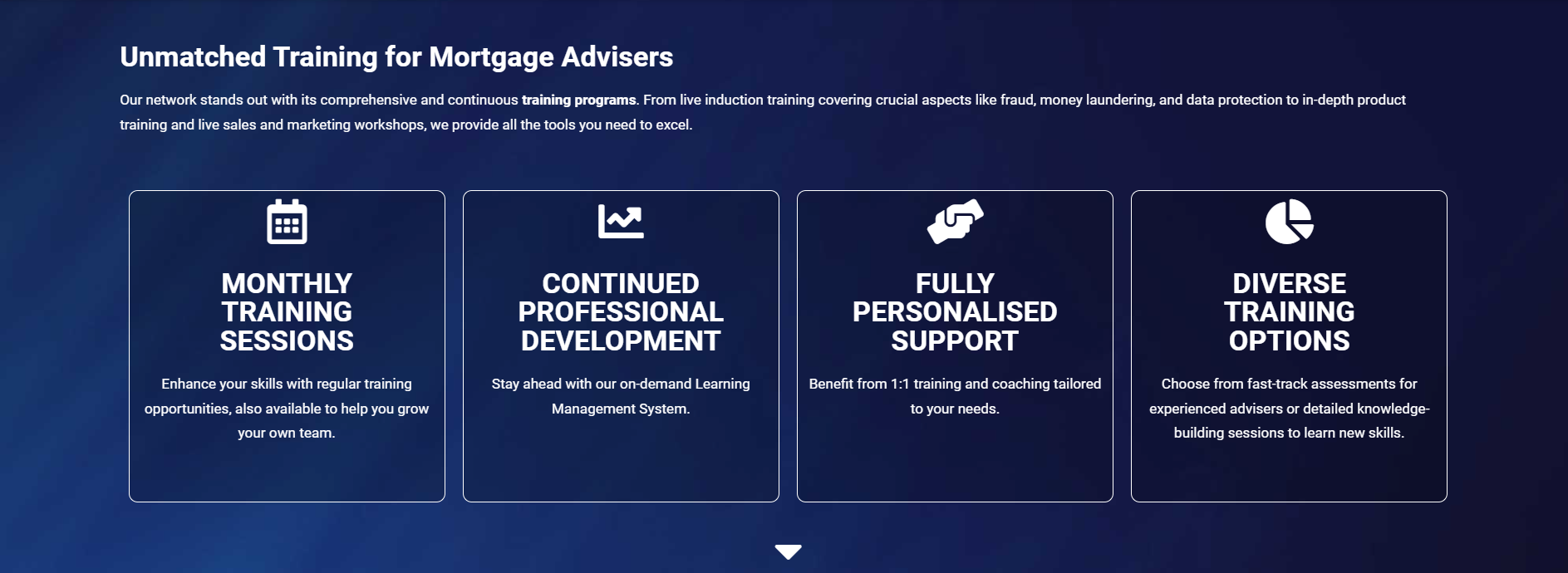

Training and recruitment support are often included. Networks can also provide better Professional Indemnity Insurance (PII) rates. For example, Connect Mortgage Network has its own insurance company, offering competitive rates.

Technology and Resources

IFA networks provide access to top-tier technology systems. These systems improve efficiency and client communication. They also aid in compliance reporting, providing good customer outcomes. Other resources include marketing services, business advice, and CPD.

One key benefit of these platforms is their ability to simplify compliance reporting. With increasing regulatory demands, advisors must ensure they maintain stringent compliance standards. The technology offered by IFA networks helps automate and manage these requirements.

This allows advisors to focus more on client service rather than administrative tasks. Moreover, this support significantly contributes to better customer outcomes. It maintains high compliance standards across all interactions and transactions.

Ready-Made Research

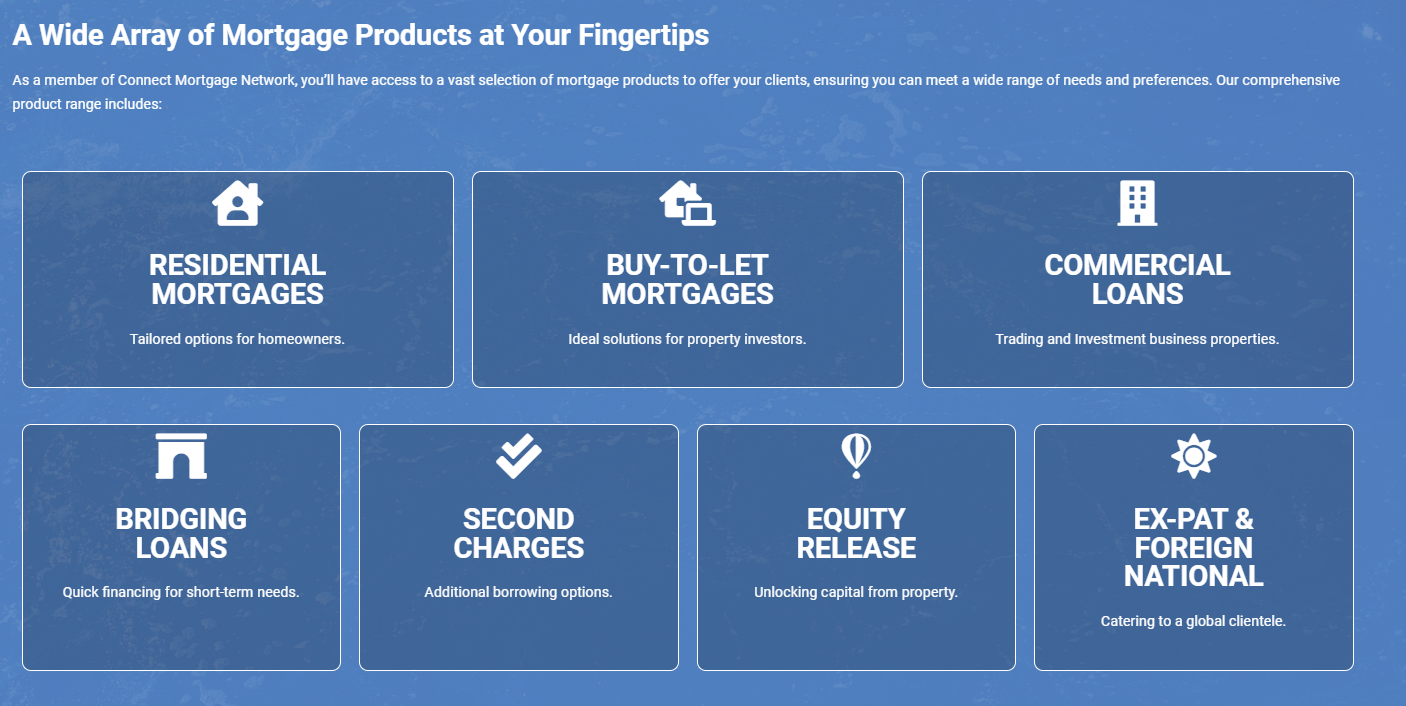

Networks are crucial for financial advisers. They provide essential support and extensive research capabilities, helping them navigate complex financial markets. These networks also provide advisers with immediate access to a wide range of financial products, including the latest market offerings.

This access ensures diversity and includes detailed assessments and due diligence by the provider. Therefore, all options are reliable and suitable for various client needs. By leveraging these ready-made research resources, advisers save time and effort in gathering information and evaluating multiple financial products.

This efficiency is particularly valuable when clients have unique or complex financial situations that require bespoke solutions. The network’s research tools enable advisers to quickly identify and match the most appropriate products to specific client profiles.

Selecting the right Network as an Appointed Representative

Choosing the right network as an appointed representative is crucial. It is like selecting the perfect bespoke suit tailored to your needs. Whether you are a newly qualified mortgage adviser, an experienced IFA, or contemplating self-employment, the right network is essential.

It is essential to find a network that offers independence and unrestricted access to products. It should also suit your client’s needs. Size matters, as larger networks often provide more comprehensive support and resources, enhancing your service capabilities.

Additionally, a supportive network that offers training and access to a full range of financial products can benefit your business in the long term. Consider the network’s ownership structure, financial strength, and stability. This ensures it can support your growth and withstand economic fluctuations.

Connect Network exemplifies these qualities. It offers a community-driven platform with a clear understanding of industry challenges. Therefore, it is a promising choice for those seeking a reliable and supportive network partnership.

Serve Your Clients Better — The Connect Network Difference

In today’s competitive market, client expectations are evolving. They demand clarity, speed, and personalised service. Our network emphasises meaningful adviser-client relationships rather than merely transactional advice. By partnering with us, you’ll be able to:

-

Offer face-to-face or virtual advice nationally

-

Build a client base using strong brand credibility

-

Access specialist training in bridging, remortgages, buy-to-let, protection and more

-

Benefit from community-driven culture and peer best practice sharing

An Eye on the Future | Ensuring Seamless Transitions for Retiring Advisers

As financial advisors approach retirement, they often wonder how to exit the industry with dignity. Ensuring clients continue to receive excellent service is paramount. Recognising this critical phase, networks have developed comprehensive support systems. These systems include practice buy-out programmes to facilitate a smooth and secure transition.

These programmes simplify the exit process for retiring advisers. By enabling practice buy-outs, networks ensure peace of mind for retiring advisers. They know their clients will remain in capable hands. The transition process is managed to maintain continuity. This allows clients to continue receiving advice and support from a trusted partner without disruption.

For advisers considering their future exit strategies, joining a network offering such programmes is advantageous. It provides a clear path to retirement. Additionally, it reassures clients that their financial needs will continue to be met. This level of professionalism and care is crucial.

Consider your future if you are an adviser looking to grow your practice confidently and securely. It is crucial to join a network that supports your career trajectory at every stage. Contact us today for more information on how network membership can support your professional journey and ultimately lead to a successful retirement.

FAQs for Prospective Independent Advisers

| Question | Answer |

|---|---|

| What is an IFA network? | An IFA network provides regulatory, compliance, marketing and infrastructure support to independent financial advisers. |

| Will I lose my independence if I join? | No. At Connect Network, you retain decision-making power for your business while benefiting from shared resources and support. |

| What does membership cost? | Our fees vary by membership tier. Your recruitment manager will provide a transparent breakdown of monthly charges and the services included. |

| Can I specialise in a niche area? | Yes. We support advisers specialising in protection, commercial finance, buy-to-let, equity release or other niche markets. |

| How long does the onboarding take? | Typically between 4-6 weeks, depending on your permissions and prior experience. We guide you to be fully operational, safe, and quickly. |

Why Now Is the Right Time

With continued regulatory change, growing client expectations and an evolving market, choosing the right support network can give you a competitive edge. Connect Network is already trusted by hundreds of advisers across the UK for our transparent culture, growth focus and whole-of-market access. Step into a future where you advise with confidence, grow your business sustainably, and remain truly independent.

Ready to transform your advisory career?

Apply today and join a network that supports your independence, amplifies your capability, and helps you serve clients better.

Thank you for reading our “Independent Financial Advisers | Join a UK-Wide IFA Network” publication. Stay “Connect“-ed for more updates soon!