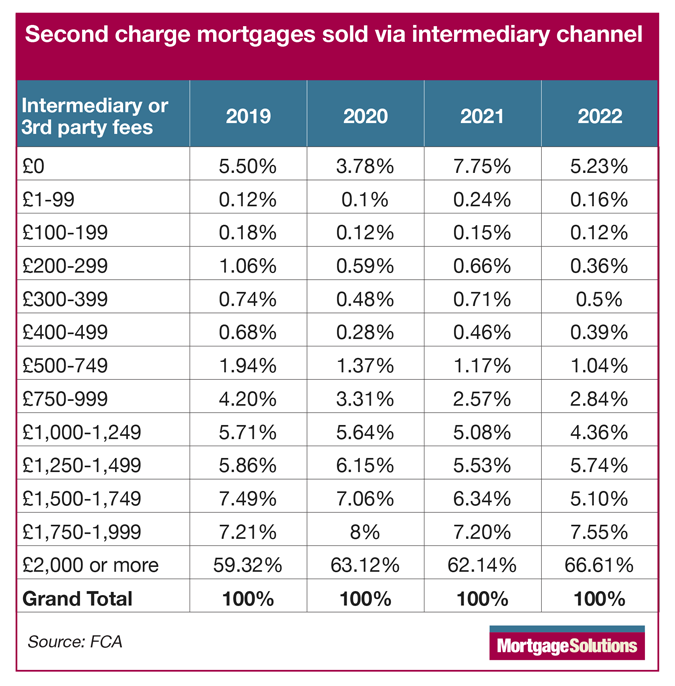

The Rising Cost of Second Charge Mortgages: What Advisers Need to Know. Recent figures from the Financial Conduct Authority (FCA) show a clear trend: second-charge mortgage fees are rising steadily. In 2022, 67% of brokered second-charge loans carried fees of £2,000 or more, a notable increase from 59% in 2019, 63% in 2020, and 62% in 2021.

This data, sourced through a Freedom of Information request submitted to the FCA by Mortgage Solutions, indicates a consistent shift in second-charge mortgage costs, affecting both brokers and clients. Just as importantly, the number of brokers offering no-fee advice has dropped from nearly 8% in 2021 to just 5.23% in 2022.

A Shift Away from Lower Fee Structures

Fees under £1,000 are becoming increasingly rare. Only 5.41% of brokers now fall within this bracket, down from 9% in 2019. Similarly, the percentage of those charging between £1,000 – £2,000 has declined steadily, dropping from 26% in 2019 to 23% by 2022.

These changes indicate evolving market dynamics, likely driven by increased compliance requirements, adviser workloads, and lender complexity in the second-charge space.

💡 Looking to support clients with complex lending needs? Explore our Specialist Mortgage Network for Advisers designed to help you navigate higher-fee, non-standard cases confidently.

Regulatory Changes in the Second Charge Market

The second charge mortgage industry has seen significant regulatory transformation over the past decade. Since 2016, second charges have been brought under the FCA’s mortgage regulatory framework, tightening expectations on compliance, advice standards, and transparency.

In 2018, the FCA issued a formal communication to lender CEOs, citing “significant issues” in second charge lending practices. Firms were strongly encouraged to review and enhance their operational procedures, ushering in a new era of compliance, customer duty, and adviser accountability.

As we move further into 2025, these trends remain relevant. With rising costs and heightened scrutiny, advisers must ensure they operate under a robust compliance framework, especially when placing second-charge deals.

📘 Need tailored support in today’s regulated landscape? Visit our Mortgage Adviser Support Hub to access compliance tools, AI-powered case support, and exclusive training resources.

First and second charge mortgages’ fee structuresare incomparable

These requirements include obtaining the credit report, checking with the existing lender on the acceptability of a second charge, and obtaining written consent. If the debt is consolidated, brokers must obtain statements from the current mortgage company and any other creditors.

They also need to obtain a desktop valuation and know when a full valuation is necessary. This involves instructing and checking the land registry for restrictions or covenants,” Syms added. She added that other obligations include establishing accounts with credit agencies and valuation providers. Each search incurs a cost and must be completed before a lender reviews the application.

Fee structures

“The adviser effectively becomes the initial underwriter, and not all advisers have the skills, knowledge, or systems to complete this work. Therefore, an adviser usually turns to master brokers specialising in this sector. The work done by this firm needs to be included in the fee charged to the client,” Syms said.

She said it’s important not to compare fees for first- and second-charge mortgages, as the “skills, process, knowledge and amount of work required are completely different.”

Nicholas Mendes, mortgage technical manager at John Charcol, agreed that approval processes were more manual for second charge, adding that less technology was used to automate parts of the approval process.

He added that rising fees could also be attributed to higher demand and tighter lending criteria, driven by rising rates and squeezed affordability.

Operational expenses on the rise for second charge mortgages

According to Positive Lending’s CEO, Paul McGonigle, the prevailing narrative suggests that two-thirds of borrowers are paying £2,000 or more. However, he clarified that his firm’s experience paints a different picture, with the average fee falling from £1,000-1,249.

McGonigle emphasised that larger fee-charging firms like his cover the client’s mortgage survey and reference request costs and absorb losses from down-valuations without passing the burden to the client.

Taking a pragmatic stance, he expressed that if mortgage brokers adopted a similar approach, it could significantly increase average mortgage fees.

Acknowledging the increased complexity and expenses associated with second charge mortgages, McGonigle highlighted an 11% rise in operational costs for this product line. Despite this, he affirmed that Positive Lending has shouldered most of these costs while remaining profitable.

The FCA will inquire about the primary beneficiary of the deal

The FCA is set to examine who stands to gain the most from a deal, questioning whether it’s the broker or the customer. According to Robert Sinclair, CEO of the Association of Mortgage

For intermediaries, the customer might not benefit significantly from the arrangement, especially if they’re borrowing existing funds and incurring broker fees. This practice could obscure higher fees, potentially reaching £3,000 or more.

Sinclair emphasises the need to address transparency issues in the sector. He points out that justifying the value and fees requires scrutiny of the work involved.

He questions the allocation of tasks between experienced advisers and administrative staff, noting that clerical personnel handle much of the work in second-charge mortgages, including legal documentation and settling existing debts.

In addition, Sinclair raises concerns about the concentration of business within a few key players in the sector. He suggests that this concentration allows the regulator to understand the landscape, prompting further examination into the practices and justifications for fees within these select entities.

Consumer Duty | The driving Force behind fee Alignment

According to Robert Sinclair, brokers in the second-charge mortgage market often justify fees by citing acquisition costs and administrative demands. These tasks include overseeing legal processes, packaging cases, and, at times, utilising in-house underwriters. Transitioning between roles, brokers ensure compliance with complex requirements, but their fees are under regulatory scrutiny.

Sinclair emphasised that regulators may compare these fees to those associated with other financial products. However, this comparison does not always account for the relative costs involved. A particular challenge arises because fees may originate from the same location but from different legal entities. This structure creates ambiguity regarding what fee levels are considered reasonable or acceptable.

Fee Alignment

Despite initial expectations that second-charge mortgage fees would gradually align with those of mainstream products, tensions remain. This disparity primarily exists between first-charge firms and second-charge firms. Sinclair highlighted that these differences in fee structures continue to pose challenges for brokers and clients alike.

While some fee adjustments have occurred due to the growing popularity of second charge mortgages, a significant gap persists. Sinclair suggested that implementing the Consumer Duty framework might help address these disparities. He views this regulatory development as an opportunity for better alignment across the market.

Looking ahead, Sinclair expressed optimism about potential changes but acknowledged ongoing challenges. He hopes fees will reduce over time, particularly as second charge mortgages gain wider acceptance. However, he also recognised the difficulty of reconciling the current significant price differences. He believes this will require careful monitoring and industry cooperation to achieve fairer outcomes for borrowers and brokers.

Some second charge brokers will need to ‘alter their approach’

McGonigle highlighted the need for brokers to adapt their models in response to these changes. He noted the long-standing push for lower fees and expressed optimism that brokers would respond positively. However, he raised concerns that dominant market players could distort data, potentially leading to inflated costs. He argued for a broader, more balanced view of market dynamics, emphasising that intermediaries are not the sole influencers.

Nicholas Mendes, mortgage technical manager at John Charcol, supported McGonigle’s perspective. Mendes stated that Consumer Duty would likely prompt second-charge brokers to reassess their fee structures. He predicted the FCA would compare charges among firms of similar size to ensure fairness. Mendes stressed the importance of brokers justifying their fees by offering fair value to customers.

Fees

Mendes acknowledged that fees for first- and second-charge mortgages may differ. However, he warned against excessive fees that could discourage competition. He noted that attempting to equalise fees with first-charge options might reduce second-charge availability. Mendes attributed this risk to profitability concerns among second-charge providers.

Mendes emphasised the need for well-supported fair value assessments to align with the regulator’s goals. This approach, he argued, would promote healthy competition while ensuring compliance with FCA standards. By adhering to these principles, brokers could maintain trust and deliver better customer outcomes.

He stressed the importance of maintaining well-justified fair value assessments for FCA inspection. This approach would align with the regulator’s strategic objectives and foster healthy market competition.

Thank you for reading our publication “Second Charge Mortgages | Two-thirds Charge £2k+ Broker Fees.” Stay “Connect“-ed for more updates soon!