Mortgage Brokers Need to Reinvent Themselves

Mortgage Brokers Need to Reinvent Themselves | The mortgage industry is undergoing rapid change. Client expectations are rising, digital tools are reshaping how advice is delivered, and the market is far more competitive than it used to be. These shifts mean mortgage advisers cannot rely solely on traditional methods. Reinvention is becoming essential for advisers […]

Consumer Duty and Client Protection

Consumer Duty and Client Protection | In today’s unpredictable housing and economic environment, safeguarding your client’s financial future goes far beyond simply finding a competitive mortgage rate. As a professional mortgage adviser, your responsibility is to ensure your clients are fully informed about financial protection options, regulatory requirements, and long-term stability. More Than Just a […]

Mortgage Support for Homeowner

Mortgage Support for Homeowners | The Charter reinforces the need for empathy and practical understanding across the mortgage market. It outlines a range of measures designed to ease pressure on homeowners and improve access to reliable mortgage support when financial circumstances change. These initiatives help borrowers stay informed, protected, and supported throughout periods of uncertainty. […]

Surveying’s Impact on Property

Surveying’s Impact on Property | How Surveying Strengthens Lending Decisions in Today’s Mortgage Market. In the modern mortgage landscape, brokers play a pivotal role in aligning clients with lending criteria. At the same time, property surveys serve as a critical checkpoint to ensure the asset’s suitability for financing. As discussed in our article on Surveying’s Impact on […]

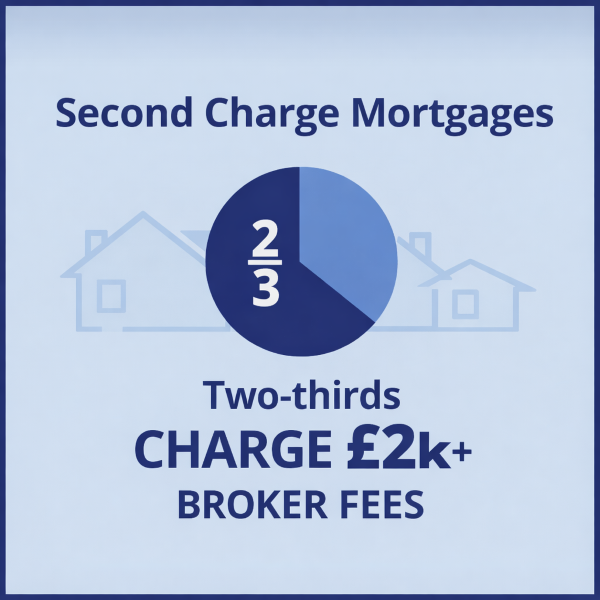

Second Charge Mortgages

It’s the final week of myth busting specialist buy-to-let with West One and they have two final misconceptions to clear. Find out more and how to be in with a chance to win a luxury hamper here…

Mortgage Fraud Explained

Mortgage Fraud Explained | Mortgage fraud remains a serious threat in the UK’s financial and property sectors. It can lead to significant financial losses for lenders, reputational damage for advisers, and long-term legal implications for borrowers. For mortgage advisers, understanding the various forms of mortgage fraud and how to detect and prevent them is essential […]

Consumer Duty

Understanding Regulation in Buy-to-Let Mortgages and the Impact of Consumer Duty. The regulation of buy-to-let mortgages has long been a topic of discussion within the mortgage industry. Liz Syms, CEO of Connect for Intermediaries, recently shared her insights on this issue in the buy-to-let section of the new Certificate Practitioner in Specialist Property Finance (CPSP). […]

Acquisitions by Specialist Lenders

The Family Building Society, helping families is central to everything they do. They have a range of mortgage options to support first time buyers including a Joint Mortgage Sole Owner arrangement and their award-winning 95% LTV Family Mortgage.

How to Get Mortgage Leads?

How to Get Mortgage Leads? | In today’s competitive mortgage market, getting consistent, high-quality leads is the difference between surviving and thriving. Whether you’re a newly qualified broker or an experienced adviser, building a sustainable client pipeline is essential, but it’s not just about numbers. The best mortgage leads are the ones that convert, and […]

Exploring The Limited Company Options

Exploring the limited company options | The buy-to-let mortgage market has undergone significant shifts in recent years, primarily driven by tax reforms and stricter regulatory requirements. As a result, more landlords and mortgage advisers are recognising the strategic benefits of limited company lending when structuring property portfolios. These changes have prompted lenders to evolve. Many […]