Find the Best Mortgage Network for Advisers

Find the Best Mortgage Network for Advisers: What to Look For & How to Choose. Choosing the right mortgage network is one of the most important decisions an adviser will make in their career. The network you join influences the support you receive, the lenders you can access, the quality of your training and the […]

Find a Mortgage Network You Can Trust

Find a Mortgage Network You Can Trust – Connect Network UK | Choosing the right mortgage network is one of the most important decisions you will make as an adviser. A trusted network shapes your career, influences how confidently you can advise clients, and determines the quality of support behind you. The right choice can accelerate […]

Regulatory Approval Options for Mortgage Firms

Regulatory Approval Options for Mortgage Firms – Network vs Direct Authorisation Explained | Choosing the right regulatory approval route is one of the most critical decisions a mortgage adviser or firm will make. Whether you join a mortgage network or apply for direct authorisation, your choice will shape your workload, compliance responsibilities and long-term growth. This […]

Do I Need a Mortgage Adviser?

Many buyers ask the same question: “Do I need a mortgage adviser?” The answer depends on your specific circumstances and your level of confidence in the market. A mortgage adviser can guide you through complex decisions and help you secure a deal that suits your needs. You may benefit from expert advice if you need […]

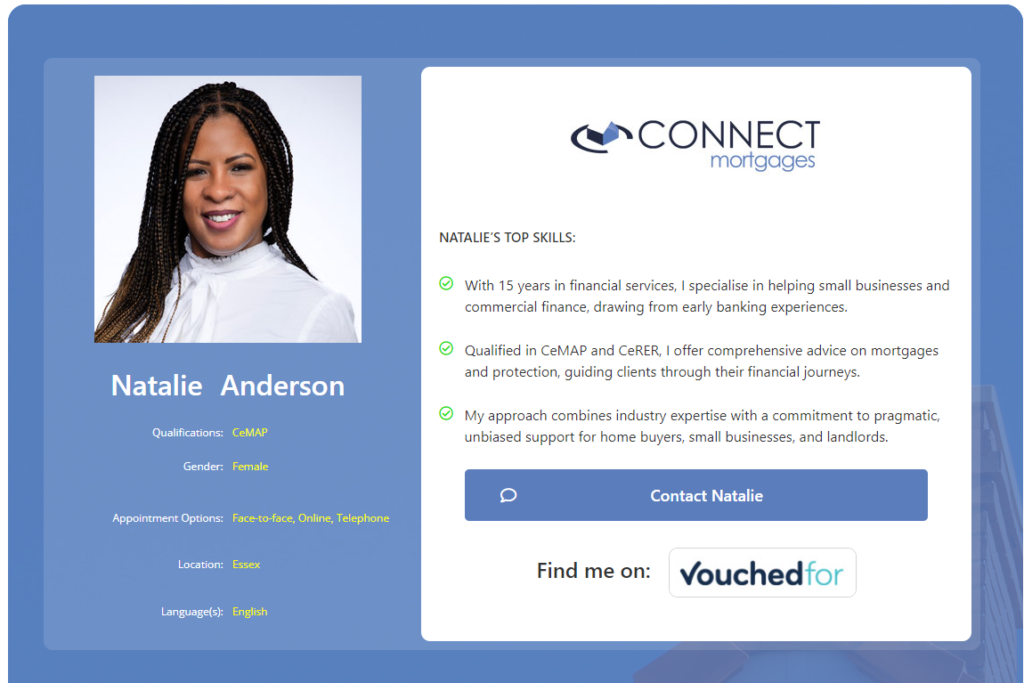

How to Find a Mortgage Broker

How to Find a Mortgage Broker in the UK | Finding a mortgage broker in the UK is essential when securing the most suitable deal for your property purchase. Why a Mortgage Broker Matters A mortgage broker, also known as a mortgage adviser, provides professional advice tailored to your income, credit, and property goals. They assess […]

Broker Vs Mortgage Lender

It’s no secret that the home-buying process can often seem challenging, especially when it comes to understanding the roles of mortgage lenders and brokers. Understanding these distinctions is essential as you pursue the purchase of your ideal home. Consider this: one entity provides direct access to financing, while the other assists you through the financial […]

Landlords Face Big Tax Rise in 2024

Landlords Face Big Tax Rise in 2024 – What to Know Now: Discover how to prepare, reduce costs, and stay ahead of the property tax reforms set to take effect this April. Mortgage Costs Rising for Buy-to-Let Landlords in 2024 This year, nearly 150,000 buy-to-let landlords will see a sharp rise in mortgage costs as […]

Join Connect for Intermediaries

Join Connect for Intermediaries, the UK’s Leading Mortgage & Protection Network | Empowering Brokers to Grow Their Business, Access More Lenders and Stay Compliant At Connect for Intermediaries, we understand the challenges of staying ahead in a rapidly changing mortgage market. That’s why we offer a nationwide network designed to support and empower self-employed brokers, […]

How to Become a Mortgage Adviser with CeMAP

How to Become a Mortgage Adviser with CeMAP | If you want to become a mortgage adviser in the UK, the CeMAP qualification is the recognised starting point. It provides the knowledge and regulatory understanding you need before giving mortgage advice to clients. This guide explains the CeMAP qualification in clear, practical terms so you […]

Specialist Lending

Specialist lending gives you access to mortgage and finance options when your situation falls outside typical high-street criteria. Whether you are self-employed, investing in property, or need income flexibility, specialist lending offers tailored solutions for complex situations. To learn more, read our Specialist Lending Guide. What is Specialist Lending? Specialist lending refers to mortgage and […]