Whole-of-Market Mortgage Networks

Whole-of-Market Mortgage Networks for UK Brokers give advisers full access to a wide lender panel, flexible criteria and full support across every stage of the mortgage process. For advisers who want unrestricted choice, this model provides the freedom to deliver the best outcomes for clients while benefiting from a network with strong compliance support, technology […]

Mortgage Networks for Intermediaries

Mortgage Networks for Intermediaries | Understanding Your Options. The UK mortgage market continues to evolve, and intermediaries face an important decision early in their journey: whether to become Directly Authorised (DA) with the FCA or to join a mortgage network as an Appointed Representative. Both routes offer clear advantages and suit different types of advisers depending […]

Mortgage Networks for Mortgage Advisers

Mortgage Networks for Mortgage Advisers | If you’re a mortgage adviser looking to expand your business, remain FCA compliant, and gain access to a broad panel of lenders, joining a mortgage network can be a game-changing decision. Whether you’re newly qualified or a seasoned professional, the right mortgage network provides the structure and support to […]

Expert Mortgage Brokers

If you’re looking for expert mortgage brokers in the UK, you need advisers who go beyond the basics. Our qualified brokers provide whole-of-market access, support for complex cases and personalised guidance at every stage. Whether you’re a first-time buyer, landlord or remortgaging, expert advice makes the difference. Why Expert Advice Matters When you work with […]

Exploring New Horizons in Later Life Lending

Later life lending is evolving rapidly, creating major opportunities for advisers. Exploring New Horizons in Later Life Lending for over 55 is essential for advisers who want to grow their business, meet Consumer Duty expectations, and support the increasing number of clients carrying mortgage debt into later life. As part of the Connect Network, brokers gain […]

Buy-to-Let and Holiday Let

Buy-to-Let and Holiday Let | The buy-to-let sector comprises properties in the private rented sector (PRS) financed by mortgages. It represents about a fifth of the UK’s total mortgage market and accommodates approximately 45% of private renters. Whether you’re an experienced landlord or a new investor, buy-to-let and holiday let mortgages offer attractive income opportunities, but […]

Do I Need a Mortgage Adviser?

Many buyers ask the same question: “Do I need a mortgage adviser?” The answer depends on your specific circumstances and your level of confidence in the market. A mortgage adviser can guide you through complex decisions and help you secure a deal that suits your needs. You may benefit from expert advice if you need […]

The Value of Mortgage Advice

The Value of Mortgage Advice | Finding the right mortgage is one of the most important financial decisions a person will make. With hundreds of lenders, thousands of products and constant changes in criteria, it is easy to feel overwhelmed. This is where professional mortgage advice becomes essential. An experienced mortgage adviser helps clients understand […]

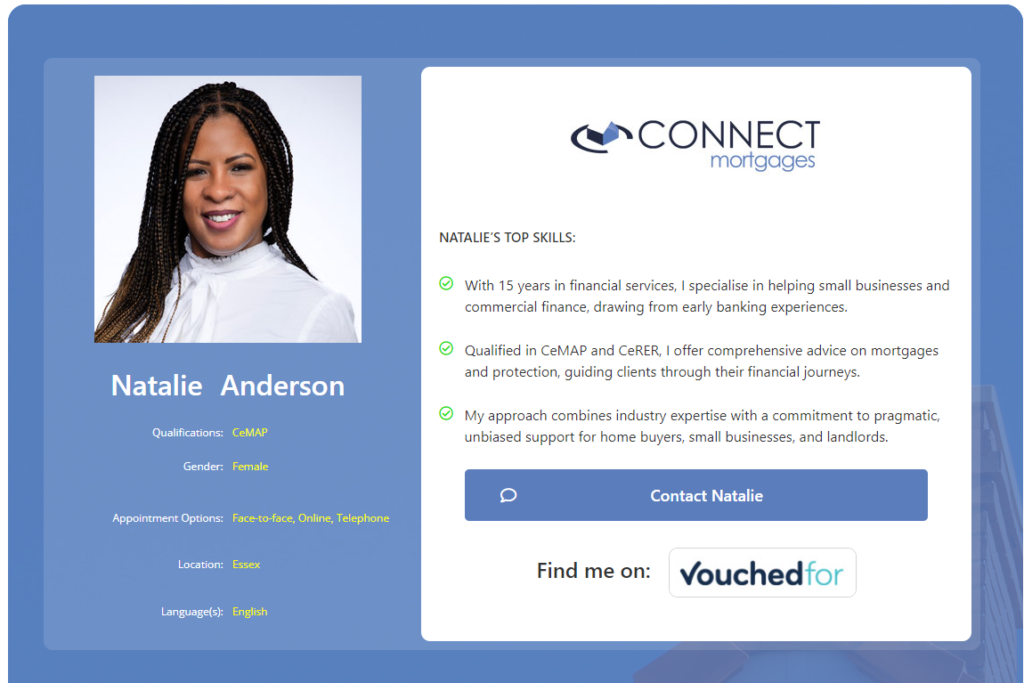

How to Find a Mortgage Broker

How to Find a Mortgage Broker in the UK | Finding a mortgage broker in the UK is essential when securing the most suitable deal for your property purchase. Why a Mortgage Broker Matters A mortgage broker, also known as a mortgage adviser, provides professional advice tailored to your income, credit, and property goals. They assess […]

Broker Vs Mortgage Lender

It’s no secret that the home-buying process can often seem challenging, especially when it comes to understanding the roles of mortgage lenders and brokers. Understanding these distinctions is essential as you pursue the purchase of your ideal home. Consider this: one entity provides direct access to financing, while the other assists you through the financial […]