How to Find a Mortgage Broker in the UK | Finding a mortgage broker in the UK is essential when securing the most suitable deal for your property purchase.

Why a Mortgage Broker Matters

A mortgage broker, also known as a mortgage adviser, provides professional advice tailored to your income, credit, and property goals.

They assess your circumstances, recommend suitable products, and often manage your application, thereby reducing the time and effort required.

Unlike banks, brokers are not restricted to one lender. They can access multiple deals across the mortgage market.

This broader access means that a broker may find rates or products that are not available directly through a high-street lender.

If you’re self-employed, have poor credit, or require complex financing, a broker can help you find suitable lenders.

Steps to Choosing the Right Mortgage Broker

1. Ask for Recommendations and Read Reviews

Start by asking family, friends, or colleagues if they’ve used a broker who provided good service.

Next, search for verified online reviews on sites such as Google Reviews and Trustpilot.

Reviews offer insights into the broker’s communication, responsiveness, and ability to secure competitive rates.

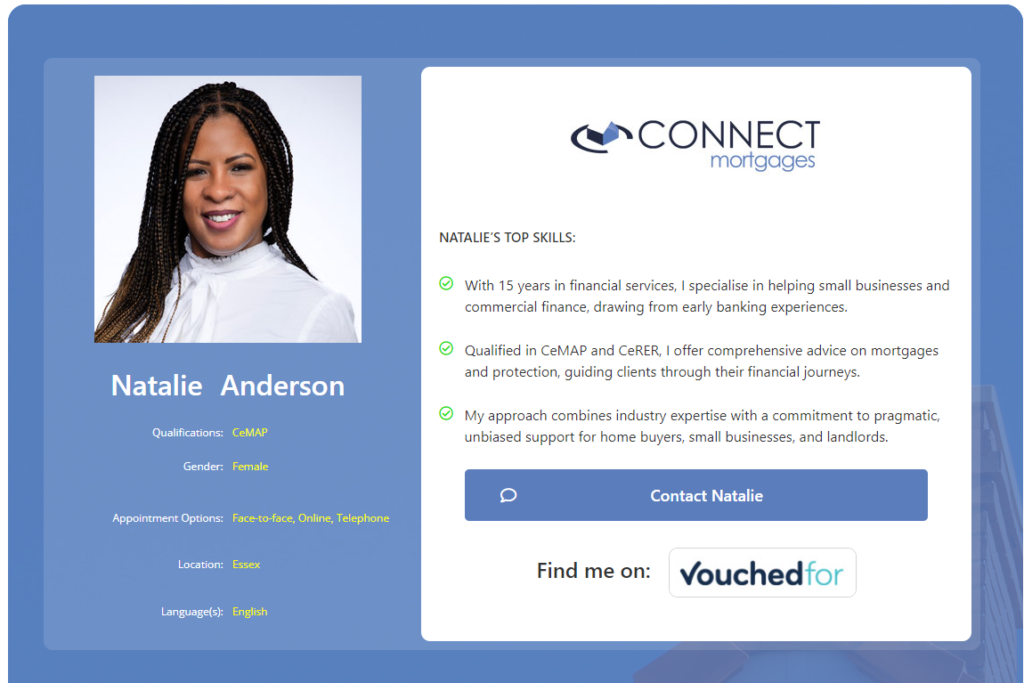

You can also check adviser directories, such as Connect’s, which list vetted professionals in your area.

2. Check FCA Registration and Qualifications

Always confirm the broker is registered with the Financial Conduct Authority (FCA) before proceeding.

Use the FCA Financial Services Register to verify their authorisation status.

Most reputable brokers hold qualifications such as CeMAP, which proves they have received formal training in mortgage advice.

Never skip this step, as it ensures you’re working with someone regulated to protect your interests.

A qualified and authorised broker will be transparent about their credentials and provide proof if requested.

3. Choose a Whole-of-Market Mortgage Broker

Some brokers only work with a select group of lenders, limiting your options for deals.

A whole-of-market broker has access to a wide range of banks and specialist lenders.

This increases your chances of securing the best mortgage based on your needs.

Always ask how many lenders they work with and whether any providers are excluded.

The broader their panel, the more competitive the options they can present.

4. Compare Broker Fees and Services

Brokers may charge fees, receive commission, or both. It’s important to understand how they’re paid.

Some brokers are free to clients because the lender pays them once the mortgage is completed.

Others charge fees, which can be a flat rate (e.g., £500) or a percentage of the loan amount.

Ask each broker: “Do you charge a fee? If so, how much and when is it due?”

Also, ask what the fee includes. For example, will they manage paperwork or assist with protection advice?

Evaluate not just the fee, but the quality of service and support provided throughout the process.

5. Speak With the Broker and Ask Questions

Before choosing a broker, arrange an initial consultation and ask specific questions.

Examples include:

-

How many lenders do you work with?

-

Do you compare broker-only and direct-to-lender deals?

-

What types of clients do you usually assist?

-

Do you charge a broker fee?

-

Will you manage paperwork and communication with lenders?

Please pay attention to how clearly the adviser responds and whether they seem helpful and knowledgeable.

Select someone who listens to your needs and explains your options in clear, straightforward terms.

If anything feels unclear or rushed, consider speaking with another adviser.

Final Tip

Start your search with the Connect Mortgage Broker Directory. It lists qualified, FCA-registered advisers across the UK.

You can filter brokers by location, services, and experience to find one who suits your needs.

Whether you prefer face-to-face meetings or digital convenience, you’ll find a trusted adviser ready to help.

Thank you for reading our publication “How to Find a Mortgage Broker | Expert Mortgage Brokers.” Stay “Connect“-ed for more updates soon!

FAQ | How to Find a Mortgage Broker?

| FAQ Question | Answer Summary |

|---|---|

| How do I find a mortgage broker near me? | Search online using phrases such as mortgage broker near me or use reputable directories like Connect Mortgages. You can filter by location and services to find a suitable broker. Many brokers also work remotely, so you are not limited to your local area. |

| Is it better to use a mortgage broker or go to a bank? | Banks only offer their own products, which may not provide the best rate or fit your needs. Brokers compare deals from multiple lenders, offer personalised advice, and manage paperwork and lender communication, saving you time and reducing hassle. |

| How can I verify if a mortgage broker is FCA-registered? | Use the FCA Financial Services Register and search for the broker’s name or firm. You can verify whether they are authorised and what services they can provide. You should never use a broker who is not FCA authorised. |

| How much do mortgage brokers charge in the UK? | Some brokers charge nothing and are paid by the lender on completion. Others may charge between £300 and £500 or up to 1% of the loan amount. Always ask about fees, when they are due, and why they apply. Charges vary depending on the service and complexity. |

| What questions should I ask a mortgage broker? | Ask about lender access, fees, service scope, communication, and availability. Key questions include: Do you have access to the whole market? Do you charge a broker fee? Will you advise on direct-only deals? Do you help with paperwork and protection? How quickly do you respond? Choose a broker who is clear, open, and responsive. |