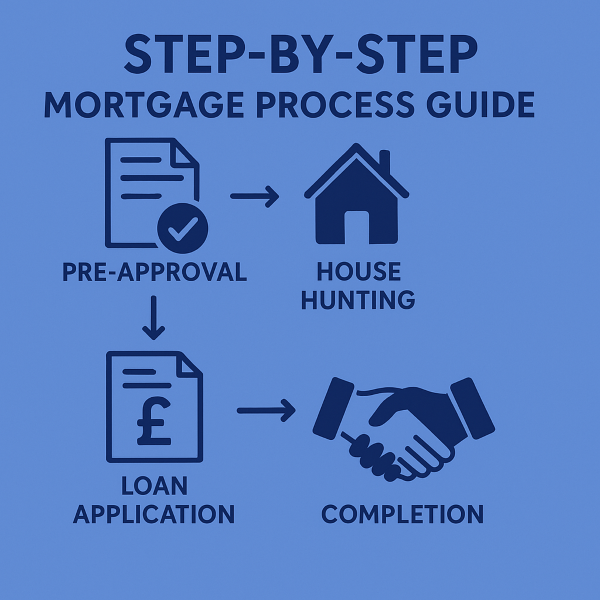

This step-by-step mortgage process guide explains each stage from planning to completion. It helps you understand the journey and avoid common delays.

You can also use our Connect Broker Directory to find a qualified mortgage broker who can support each step.

Step 1: Assess Your Affordability

You must understand your budget before you start.

Check your income, spending and deposit size.

Your mortgage broker can conduct an affordability check on your behalf.

Learn more using our first-time buyer mortgages guide.

Step 2: Check Your Credit Score

Your credit score affects your mortgage options.

Check your score with major UK agencies.

A strong credit score improves your chance of approval.

Your mortgage broker can explain lender credit requirements.

Step 3: Get a Mortgage Agreement in Principle

A Mortgage Agreement in Principle confirms your potential borrowing.

Most estate agents request it before accepting an offer.

You can obtain this through your mortgage broker.

It improves your position as a buyer.

Step 4: Make an Offer on a Property

Submit your offer once you find a property.

Estate agents will confirm acceptance or negotiate.

Your AIP strengthens your offer.

Your broker can advise on suitable offer levels.

Step 5: Complete Your Full Mortgage Application

Your broker will submit your full mortgage application.

You must provide documents like payslips, bank statements and ID.

Ensure documents are clear and up to date.

You may also consider reviewing mortgage protection options.

Step 6: Mortgage Valuation and Underwriting

Lenders complete a property valuation to confirm the property value.

Underwriters check your affordability and documents.

Your broker will manage communication with the lender.

Valuation results can affect the final offer.

Step 7: Receive Your Mortgage Offer

The lender issues a formal mortgage offer after checks.

Review the offer carefully with your financial advisor or broker.

Ensure that all details match your expectations and the agreed-upon terms.

This document enables the continuation of legal work.

Step 8: Conveyancing and Legal Checks

Your solicitor completes searches and reviews contracts.

They confirm ownership, boundaries and legal risks.

This stage can take several weeks.

Reply quickly to solicitor questions to avoid delays.

Step 9: Exchange Contracts and Pay the Deposit

You exchange contracts once the checks are complete.

You are now legally committed to buy the property.

You pay your deposit at this stage.

Your solicitor agrees on the completion date with all parties.

Step 10: Completion and Move-In Day

Your lender releases funds on completion day.

Your solicitor transfers money to the seller.

You receive your keys and can move into your new home.

Your mortgage payments will start after completion.

Use the Connect Broker Directory to find a mortgage broker who can support every step.

A qualified adviser improves your chances of a smooth mortgage process.

You can also explore remortgage advice or buy-to-let mortgages if needed.

Thank you for reading our publication “Step-by-Step Mortgage Process Guide | UK Mortgage Help .” Stay “Connect“-ed for more updates soon!

FAQ Step-by-Step Mortgage Process Guide

| FAQ Question | Answer |

|---|---|

| How long does the mortgage process take? | The process usually takes six to twelve weeks. Timeframes vary depending on the lender and solicitor. |

| Do I need a mortgage broker? | A broker can save you time and money. Use our Connect Broker Directory to find a qualified adviser. |

| What documents will I need? | You will need to provide ID, income documents, bank statements, and deposit evidence. Your mortgage broker will guide you. |