Fast Bridging Loans UK | Short-Term Property Finance in the UK Mortgage Market. In the fast-paced UK property market, securing quick funding is often crucial for investors and businesses. Traditional loans, however, may not consistently deliver funds swiftly enough to meet urgent demands. Therefore, bridging loans have emerged as a flexible short-term financing option for effectively addressing time-sensitive needs.

Fast Bridging Loans UK | Short-Term Property Finance in the UK Mortgage Market. In the fast-paced UK property market, securing quick funding is often crucial for investors and businesses. Traditional loans, however, may not consistently deliver funds swiftly enough to meet urgent demands. Therefore, bridging loans have emerged as a flexible short-term financing option for effectively addressing time-sensitive needs.

Many investors purchase properties at auctions, where immediate payment is often required. Consequently, bridging loans can ensure funds are available promptly, helping buyers meet tight schedules. Businesses undertaking renovations often rely on bridging loans to cover refurbishment costs before refinancing with longer-term solutions.

Bridging loans also help resolve temporary cash flow shortages. This allows property investors to maintain momentum without missing lucrative opportunities. Moreover, these loans benefit those waiting for property sales to be finalised or facing chain breaks.

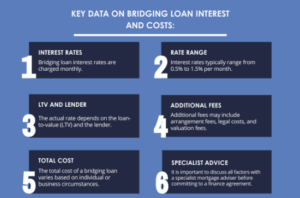

Unlike traditional mortgages, bridging loans are secured against property assets, enabling quicker approval processes. As a result, borrowers can proceed confidently without prolonged delays. Interest rates tend to be higher, reflecting the short-term nature and convenience of this type of finance.

Bridging loans are tailored for various purposes, including residential, commercial, and mixed-use properties. Lenders assess affordability by evaluating exit strategies, ensuring clear, achievable repayment plans. Therefore, borrowers must carefully evaluate the terms before committing.

Overall, bridging loans are essential in providing rapid financial solutions across the UK property sector. They support investors, developers, and businesses in capitalising on opportunities without delays caused by traditional lending processes. As property markets evolve, bridging finance remains reliable for those seeking flexible, short-term funding solutions.

What Is a Fast Bridging Loan?

A fast bridging loan is a short-term secured loan designed to release funds quickly, often within days. Many borrowers use bridging finance when a standard mortgage would take too long or when a property requires work before a lender will approve long-term funding.

Fast bridging loans are commonly used for:

-

Chain breaks

-

Auction purchases

-

Refurbishment projects

-

Buy-to-sell (flip) strategies

-

Short-term cashflow needs

-

Capital raising for investments

The key advantage is speed: decisions can be made in hours and funds released far quicker than with traditional banks.

Bridging Loans in the UK Property Market

Fast Access to Funds

- Approvals within days, not weeks, are ideal for auction property finance or urgent purchases.

Flexible Loan Terms

- Short-term borrowing tailored for projects like property development finance or refurbishments.

No Monthly Repayments (Interest Roll-Up Options)

- Preserve cash flow with interest roll-up options until the loan matures.

Wide Range of Uses

- Suitable for commercial bridging loans, property purchases, renovations, or even tax liabilities.

Higher Borrowing Potential

- Loans secured against property value rather than income, perfect for property development finance.

Property Development and Investments

- Flexible funding for property developers and investors who need short-term property finance to keep projects moving.

Why Choose Connect for Bridging Loans?

Specialist Expertise in Bridging Loans

- Over 25 years of experience delivering bridging finance solutions.

Access to Over 200 Lenders

- Extensive lender partnerships offering competitive bridging loan rates in the UK.

Dedicated Case Management

- Simplified processes for securing quick property loans from application to completion.

Fully FCA-Compliant and Secure Lending

- Authorised and regulated advice on commercial bridging loans and property development finance.

Seamless Application Process

- Hassle-free approvals to ensure you get the fast property finance you need.

Everyday Use Cases for Bridging Loans

| Use Case | Description |

|---|

| Auction Purchases | Fast bridging loans enable buyers to secure auction properties without waiting for a traditional mortgage. Funds can be released quickly, helping you meet strict auction deadlines and move ahead of competing bidders. |

| Renovations & Refurbishments | Short-term property finance is ideal for light, medium or heavy refurb projects. Investors can access funds immediately to begin repairs, add value to a property, or bring an unmortgageable asset up to standard before refinancing. |

| Property Chain Delays | Bridging loans in the UK offer a practical solution to prevent a collapsed chain. Clients can complete their purchase on time, even if the sale of their existing property is delayed, ensuring the overall transaction remains secure. |

| Business Growth & Expansion | Commercial bridging loans give businesses fast access to capital for expansion, equipment, premises upgrades, or short-term cash flow needs. This allows companies to move quickly without waiting for lengthy commercial mortgage approvals. |

| Debt Consolidation | Fast property finance can help borrowers consolidate high-interest debts into one short-term facility. This can improve cash flow, reduce monthly commitments, and provide breathing room before refinancing onto a long-term solution. |

How Does a Fast Bridging Loan Work?

A fast bridging loan is a short-term secured loan designed to release funds quickly when traditional finance would take too long. It is commonly used for urgent property purchases, auction deadlines, refurbishment projects, or situations where buyers need to complete before their existing property sells. Bridging finance gives borrowers the flexibility to act immediately while arranging a longer-term solution in the background.

Bridging loans are secured against residential or commercial property, reducing lender risk and enabling rapid decision-making. Borrowers can choose between open bridging loans, which have no fixed repayment date, and closed bridging loans, which commit to a defined repayment deadline under an agreed exit strategy.

Because bridging loans are short-term and designed for quick turnaround, interest rates are typically higher than standard mortgage products. However, for time-sensitive opportunities, the speed and flexibility they offer often outweigh the higher costs. Most borrowers repay their bridging loan through property sale, refinancing, or equity release once their project or transaction is complete.

To qualify, applicants must demonstrate a clear and achievable exit strategy. Lenders will assess the strength of the security property, the credit profile, the experience level, the project’s viability, and the overall repayment plan. Preparing key documents such as valuations, renovation schedules, proof of funds, or business accounts can help speed up the process.

Property investors, landlords and developers widely use fast bridging loans. They are ideal for refurbishments, conversions, auction purchases, chain breaks and portfolio expansion. By providing immediate access to capital, bridging finance enables borrowers to secure opportunities that would otherwise be missed.

Although bridging loans are highly versatile, they must be approached with care. Failure to repay on time can result in additional costs or repossession of the secured property. Seeking professional advice ensures borrowers choose the right structure and exit strategy for their circumstances and reduces risks associated with short-term lending.

Start Your Fast Bridging Loan Enquiry

Whether your client needs funds in days or has a complex scenario, Connect can quickly guide you to the right lender. Fast bridging loans offer a practical solution when time, flexibility and opportunity are key.

Thank you for reading our publication “Fast Bridging Loans UK | Quick Property Finance Solutions.” Stay “Connect“-ed for more updates soon!

FAQ – Fast Bridging Loans UK

| Question | Answer |

|---|---|

| What is a fast bridging loan? | A short-term secured loan designed to release funds quickly, usually within days, for property purchases, refurbishments, or urgent finance needs. |

| How quickly can bridging finance be arranged? | Some lenders can issue decisions within hours and release funds within 3–7 days, depending on legal work and property checks. |

| What can a fast bridging loan be used for? | Auction purchases, chain breaks, refurbishment projects, buy-to-sell strategies, and short-term cashflow requirements. |

| What loan-to-value (LTV) is available? | Most lenders offer up to 75% LTV, although higher LTVs may be available with additional security. |

| Do I need an exit strategy? | Yes. A clear exit plan, such as refinancing, selling the property, or releasing equity, is essential for approval. |

| Can bridging loans cover refurbishment costs? | Yes. Many lenders accept light, medium, and heavy refurbishment projects and release funds in stages if required. |

| Are credit issues accepted? | Often yes. Bridging lenders typically focus on asset value and exit strategy rather than perfect credit history. |

| What fees are involved? | Common fees include interest, arrangement fees, valuation costs, legal fees, and, depending on the lender, exit fees. |

| Can first-time investors get bridging finance? | Yes, although lenders may request additional information or security. Experienced investors may access more flexible terms. |

| Is bridging finance regulated? | It depends. Bridging loans secured on a borrower’s main residence are regulated, while investment-based loans are usually unregulated. |