Join an Adviser-First Mortgage Network | In today’s fast-paced mortgage sector, choosing the right mortgage network is one of the most important decisions you will make as a professional adviser. Whether you are newly qualified or an experienced broker looking for more substantial support, you need a mortgage network that is transparent, adviser-focused, and equipped to help you grow. The Connect Network provides advisers with access to a specialist lending panel, dedicated compliance support, robust technology, and a development framework designed to help you build a long-term and sustainable business.

Many advisers join Connect because they want more than permissions and lender access. They want a partner that understands the challenges of running a mortgage business and provides the systems, training and guidance needed to operate confidently. Connect has built a reputation as one of the most trusted mortgage networks in the UK, offering advisers a clear route to growth through hands-on support, a wide lender panel and a consistent commitment to professionalism.

Suppose you are searching for a mortgage network that prioritises advisers and offers comprehensive support across residential, buy-to-let, specialist, and commercial lending. In that case, Connect provides a proven and reliable pathway. With structured onboarding, expert supervision for newly qualified advisers, and access to over 200 lenders, the network is designed to help you deliver better outcomes for clients while growing your business with confidence.

A Trusted Mortgage Network Designed for Adviser Growth

Joining the Connect Mortgage Network gives you access to a transparent, adviser-focused structure that supports growth at every stage of your career. Whether you are newly qualified, switching networks, or expanding your firm, you receive clear compliance guidance, dedicated business development support, and practical tools that help you build long-term success.

Our broad lender panel and specialist market expertise ensure you stay competitive and fully informed across residential, buy-to-let, specialist and complex lending. With Connect, you gain a modern mortgage network committed to helping advisers deliver better outcomes for clients while growing a strong, sustainable advisory business.

Professional Development With the Connect Academy

Whether you are taking your first steps toward becoming a qualified mortgage adviser or looking to grow your skills in a new lending area, the Connect Academy provides a structured and supportive learning environment. Our training pathways are designed to help advisers build confidence, meet regulatory standards, and develop practical expertise.

The Academy is ideal for:

-

New entrants who want to become fully qualified and join a trusted mortgage network

-

Existing advisers who wish to expand into specialist areas such as Buy to Let, Commercial or Bridging finance

-

Advisers preparing to join the Connect Network and wanting a strong understanding of systems, compliance and lender criteria

Through a blend of hands-on learning, expert mentoring and clear regulatory guidance, the Connect Academy prepares advisers for real-world advice, not just classroom theory. It forms a key part of our joint approach to adviser development, supporting those who plan to:

-

Join our network

-

Strengthen their specialist knowledge

-

Build a long-term, sustainable advisory business

Boost Your Visibility with the Connect Expert Directory

A key advantage of joining the Connect Mortgage Network is the Connect Expert Directory. This unique broker directory is designed to help clients find the right adviser quickly and confidently. It supports advisers who want stronger visibility, better lead opportunities, and a professional platform that showcases their strengths.

The Expert Directory allows clients to search for advisers by location, product expertise, language, and gender. This makes it easier for them to connect with a broker who understands their situation and can deliver the right advice. It also supports better quality conversations because enquiries are matched with advisers who specialise in the area the client needs.

As an adviser, the directory enhances your online presence, fosters trust, and establishes you as a specialist within your chosen market. It also forms part of our wider network support, which includes training, compliance guidance, and a broad lender panel. You can learn more about how our network helps advisers grow by visiting our Join Our Network page at connectbrokers.co.uk/join-our-network.

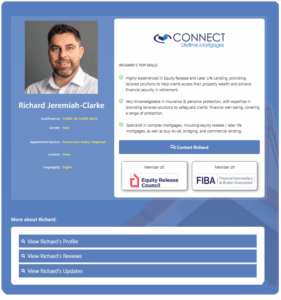

Meet Richard Jeremiah Clarke, one of our appointed representatives in the Connect Mortgage Network. His profile in the Expert Directory shows how your own listing can appear, including details such as location, specialist areas, gender, and languages spoken.

Earn Commission Easily With Our Trusted Mortgage Referral Partnership

If you want to support your clients with professional mortgage solutions without providing advice yourself, our Referral Partnership offers a reliable and straightforward way to generate additional income. It is ideal for professionals who want to add value to their clients while avoiding the responsibilities and regulatory requirements of mortgage advice.

This service is designed for:

-

Solicitors

-

Accountants

-

Estate agents

-

Professionals who the FCA does not authorise to give mortgage advice

You can introduce clients to a fully regulated and experienced adviser team while remaining completely outside the scope of FCA authorisation. We manage the full advice journey, including research, recommendations, lender communication, and case progression.

Why Work With Us

By working with our network, you benefit from:

-

Access to the full mortgage market, including specialist and intermediary-only lenders, is often unavailable through packaged or restricted routes

-

A transparent and fair commission structure that rewards every successful referral

-

Smooth client handling through Legal and General SmartrRefer, ensuring clear communication and excellent service

Our referral partnership allows you to enhance the support you offer clients, strengthen long-term relationships, and build a valuable new revenue stream with minimal effort.

If you want to explore wider adviser support or join a network, you may also find the following pages helpful:

Thank you for reading our publication “Connect Network Proposition | Join Our Mortgage Network.” Stay “Connect“-ed for more updates soon!