Becoming an Appointed Representative is one of the most efficient ways for mortgage advisers and firms to operate under a trusted FCA-regulated network without the cost and complexity of Direct Authorisation. As an AR, you gain immediate access to lender panels, compliance support, technology platforms and business development guidance that allow you to focus on delivering high-quality advice to clients.

At Connect Mortgage Network, we provide a structured pathway for advisers who want to grow their business with confidence. Whether you are newly qualified, an experienced adviser seeking greater support, or a firm looking for a principal who understands both specialist and mainstream lending, our AR programme is designed to help you develop, stay compliant, and build long-term success.

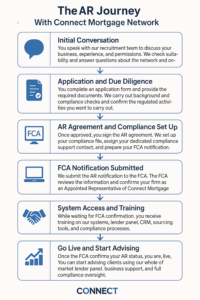

This guide explains what it means to become an Appointed Representative, how the process works, what support you can expect from our network and why so many advisers choose Connect as their principal firm.

Comparison Table: AR vs Direct Authorisation vs Network-Joined Adviser

Comparing Compliance Routes for Mortgage Advisers

| Feature | Appointed Representative (AR) | Directly Authorised (DA) | Network-Joined Adviser (Under DA Firm) |

|---|---|---|---|

| Regulatory Permission | Works under a principal firm’s FCA permissions | Holds independent FCA authorisation | Works under an existing DA firm’s permissions |

| Compliance Responsibility | The principal firm manages all compliance and oversight | An adviser or firm manages all compliance alone | DA firm provides full compliance support |

| Startup Time | Fast onboarding and FCA notification handled by the principal firm | It can take several months due to full FCA authorisation | Fast onboarding controlled by the host firm |

| Costs | Monthly fees and revenue share, lower general operating costs | FCA fees, PI insurance, systems, compliance staff, and higher cost | Fee structure set by the DA firm, usually with a low entry cost |

| Lender Access | Whole of market access through the principal firm | Whole of market access depending on DA’s own setup | Lender panel set by the DA firm |

| Branding Control | Can use own brand or the network’s brand | Full control of branding and marketing | Typically allowed to use own branding within DA guidelines |

| Best For | Growing advisers and small firms that want support and fewer regulatory burdens | Experienced firms that want full independence and control | New advisers or advisers who prefer a simple way to trade without full network membership |

| Training and Development | Provided by the principal firm | Self-managed unless paid for separately | Provided by the DA firm |

| Business Growth Support | Strong support with development, systems, and case placement helps | Self-managed | Provided by the DA firm based on their model |

Which Regulated Activities Will You Carry Out?

Which Regulated Activities Will You Carry Out?

The first step is to decide which regulated activities you want to perform. These could include mortgage advising, insurance brokering, or investment advising. It is crucial to choose a principal firm with permission to carry out these activities.

Connect Mortgage Network, for example, offers a wide range of services, ensuring you have the necessary backing to perform your chosen activities.

Do You Want to Be an AR or an IAR?

Next, consider if you want to be an AR or an Introducer Appointed Representative (IAR). An IAR is limited to making introductions and distributing financial promotions, while an AR can engage in a broader range of activities. Your decision will depend on the scope of services you wish to offer and your career goals.

Connect Mortgage Network can help you understand these roles better, ensuring you make an informed choice.

How Many Principals Do You Want?

The number of principals you work with will influence your business operations. Most ARs work with a single principal, but some choose to work with multiple principals if they offer diverse services. However, some regulated activities require exclusivity to one principal. Understanding these nuances is essential, and Connect Mortgage Network can guide you in effectively structuring your relationships with principals.

What Contracts Will You Need?

Entering into a formal agreement with your principal is a vital step. This contract outlines the responsibilities and expectations of both parties. Ensuring that the agreement covers all necessary aspects of your operations is essential. Connect Mortgage Network assists in drafting and reviewing these contracts to ensure they meet regulatory standards and protect your interests.

Is Your Principal Ready to Notify the FCA?

Before you can start operating as an AR, your principal must notify the Financial Conduct Authority (FCA) of your appointment. This notification must be done 30 days before and include detailed information about you. The FCA will then add this information to their Financial Services Register.

Connect Mortgage Network will handle this process efficiently, ensuring compliance and a smooth start to your operations.

What to Prepare

Your principal will conduct thorough checks to ensure you are fit, proper, financially solvent, and competent. They are responsible for your business, so it’s crucial to demonstrate your reliability and expertise. Connect Mortgage Network supports you through this vetting process, providing training and resources to enhance your credibility.

Be Your Own Boss

As an AR, you will enjoy the freedom of being self-employed. This role allows you to build your client base and set your working hours, offering the flexibility to balance work and personal life. While representing Connect Mortgage Network, you retain the independence of running your own business.

This combination of support and autonomy is ideal for motivated individuals seeking career growth in financial services.

How Connect Mortgage Network Can Help

Connect Mortgage Network offers comprehensive support to aspiring ARs. From initial consultations to ongoing training and regulatory compliance, their expert team is dedicated to helping you succeed. They provide valuable resources, mentorship, and industry insights, ensuring you are well-equipped to navigate the complexities of the financial services sector.

Selecting The Right Network As An Appointed Representative

Whether you’re a newly qualified CeMAP graduate or an experienced mortgage adviser, this article is for you. It is also relevant if you’re an IFA or considering self-employment. Becoming an appointed representative is a significant decision, akin to commissioning a bespoke suit where every detail is tailored to your needs.

Choosing the right network is crucial. It becomes the foundation of your business, providing opportunities, partnerships, and support. Ensure the network offers comprehensive support and unrestricted access to all products. This includes training and development. Consider the network’s ownership, longevity, financial strength, and ability to meet your future needs.

Connect Network, created by brokers for brokers, offers all these qualities. It ensures your success and growth in the mortgage industry. Connect Network is the ideal choice if you’re seeking a network that genuinely values your potential.

What next?

If you’re ready to take the next step in your career and become an appointed representative, Connect Mortgage Network will guide you. Contact us today to learn more about how we can help you achieve your professional goals and build a thriving business in the financial services industry.

By filling out our form, you can join us and become part of a network that values your success and supports your journey every step of the way.

Book a Call | Speak with our Business Recruitment Manager, who will be happy to answer all your questions. #talktotracy

Thank you for reading our publication “Become an Appointed Representative | Connect Network UK.” Stay “Connect“-ed for more updates soon!

FAQ: Becoming an Appointed Representative

| Question | Answer |

|---|---|

| What is the difference between an Appointed Representative and an Introducer Appointed Representative? | An Appointed Representative is authorised to give regulated mortgage or protection advice under the permissions of a principal firm. An Introducer Appointed Representative can only introduce clients and cannot provide regulated advice. ARs assume a broader role with increased responsibility and access to a comprehensive range of network support. |

| How long does it take to become an Appointed Representative? | Most advisers complete the onboarding process within four to six weeks. This includes due diligence checks, agreement of permissions, training, and system setup. The timeline varies depending on experience, documentation, and compliance requirements. |

| What are the typical costs involved in joining a mortgage network as an Appointed Representative? | Most networks charge a monthly fee, a percentage of commission, or a combination of both. Costs usually cover compliance, technology systems, network support, and ongoing training. Always request a full cost breakdown before joining. |

| Can I still use my own branding as an Appointed Representative? | Yes. Many networks allow you to trade under your own brand while operating with the permissions of the principal firm. This gives you independence while still benefiting from compliance oversight and lender access. |

| Is being an Appointed Representative better than being Directly Authorised? | It depends on your goals. Direct Authorisation provides full independence but requires managing compliance, reporting, and regulatory risk. AR status is often chosen by advisers who want support with oversight, technology, lender access, and FCA processes. |

| What support does a principal firm provide to Appointed Representatives? | A good principal firm provides compliance oversight, file checks, audits, training, lender panel access, sourcing systems, and business development support. This helps advisers focus on client work instead of administration. |

| Do I need previous mortgage experience to become an Appointed Representative? | Experience helps, but some networks accept newly qualified advisers. Most networks offer training, supervision, and mentoring to assist advisers in meeting regulatory standards. |

| Can I transition from AR status to Direct Authorisation later? | Yes. Many advisers start as ARs to build experience and understanding of compliance. Once established, they may choose to become Directly Authorised. Some networks offer clear progression routes. |

| Are there limits to the types of mortgages I can advise on as an AR? | Your permissions depend on the agreement you have with the principal firm. Some ARs offer residential-only services, while others provide a range of options, including buy-to-let, commercial, bridging, and protection. Networks vary, so always check lender panel availability. |

| What happens if my business grows and I want to hire advisers? | Many networks support AR firms that plan to expand. You can add advisers under your structure as long as they meet the network’s compliance requirements. Growth planning is usually part of the network support package. |